- Real estate conveyance form how to#

- Real estate conveyance form pdf#

- Real estate conveyance form code#

- Real estate conveyance form download#

- Real estate conveyance form free#

For additional information the Tax Maps/GIS office can be contacted at 93. NOTE: The legal description must be approved by Tax Maps/GIS and a stamp must be placed upon the deed indicating the same before it can be processed. DTE 23 V Veterans’ and Fraternal Organization Renewal Form.

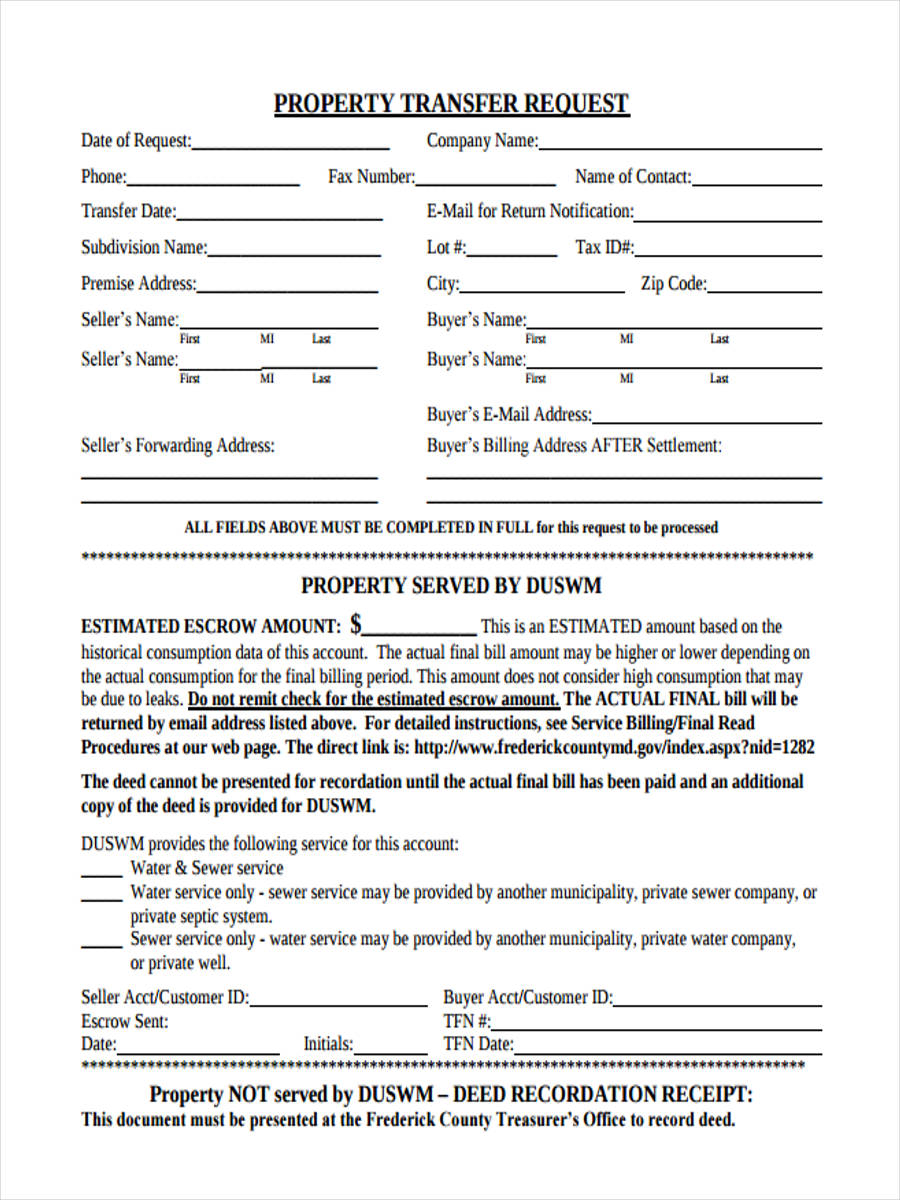

We will forward the documents to the Recorder’s office after they are processed unless instructed otherwise. DTE 102 FI Statement of Conveyance of Current Agricultural Use Valuation Property. Please be aware that this method may prolong the process as the documents may be rejected for items such as incorrect fees, missing or incorrect legal description, missing Conveyance form, etc. Please contact the Recorder’s office at 93 to verify their fees.īy Mail: If you wish to file your deed by mail: mark the order the documents should be processed, include your contact information, a SASE, and verify that you have the correct documents and fees. Please bring all the necessary documents and Auditor’s fees. During these hours we are available to assist with filing a deed with our office. The office is open from 8:00am to 4:00pm Monday through Friday, closing at 3:00pm on Wednesday. In Person: Our office is located at 46 South South Street, Wilmington, Ohio 45177. Make checks payable to the Clinton County Auditor. For example, if 3 parcels are transferred in a deed, $1.50 will be charged as a transfer fee. Conveyance is the process of transferring property ownership from one party to another.

Real estate conveyance form download#

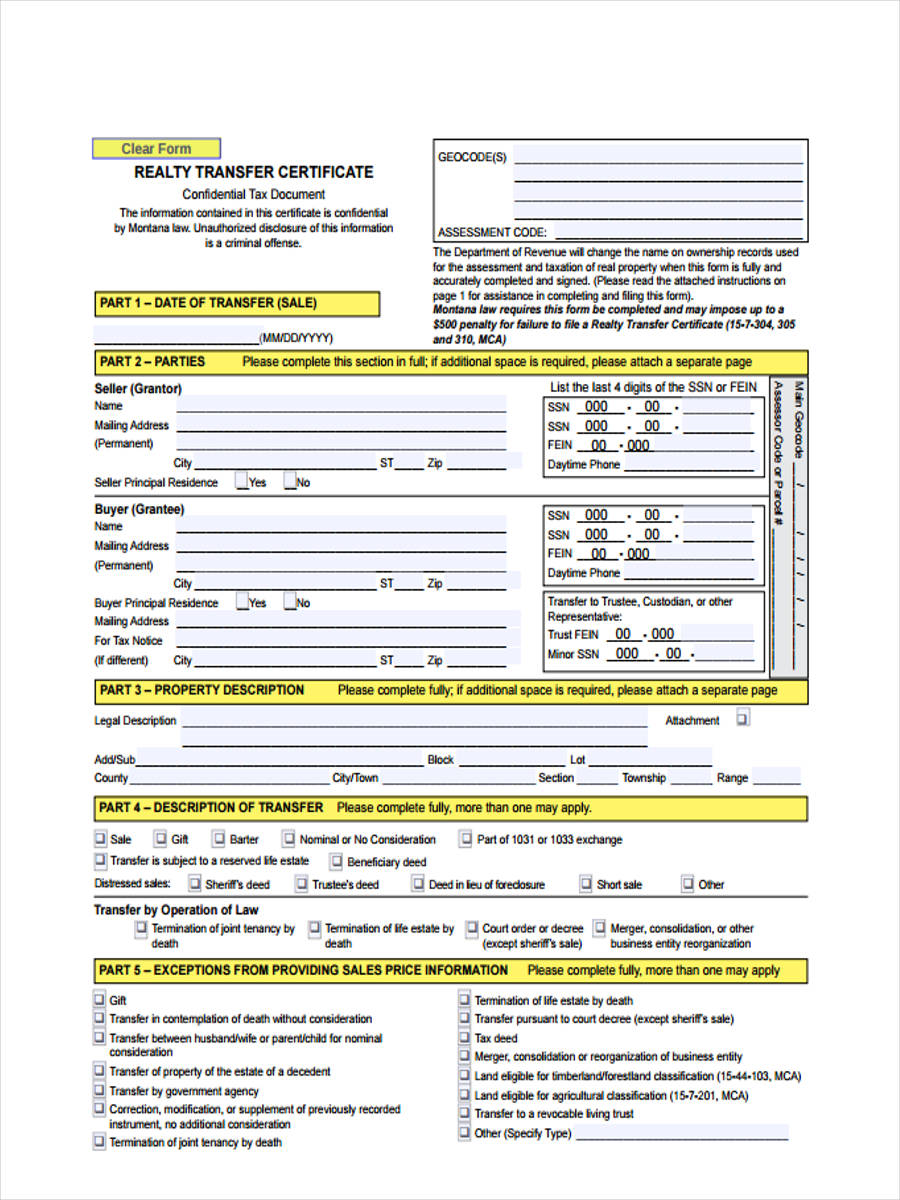

Download DTE FORM 100 The updated Real Property Conveyance Fee Statement.

Real estate conveyance form code#

Transfers are done in accordance with the Ohio Revised Code Section 319.203.

Under Ohio law, all real estate transfer-related documents must be presented to the County Auditor before recording. If you have a substantive question or need assistance completing a form, please contact Taxpayer Services at (603) 230-5920.Transfer and identification documents track the transfer of parcels and maintain the Auditor’s parcel numbering system for tax purposes. To request forms, please email or call the Forms Line at (603) 230-5001. Additional details on opening forms can be found here.

Real estate conveyance form how to#

Adobe provides information on how to adjust your browser settings to view PDFs. Each browser has its own settings to control how PDFs open from a web page.

Real estate conveyance form pdf#

Please follow the above directions and use a different PDF Reader. Note for Apple users: Apple Preview PDF Reader does not support calculations in forms. Print the form using the 'Print Form' button on the form for best results.

Real estate conveyance form free#

(Adobe's Acrobat Reader is free and is the most popular of these programs.)ĥ. Open the form using a PDF Reader that supports the ability to complete and save PDF forms. Choose a location to save the document and click "Save."Ĥ. Select “Save Target As” or “Save Link As.”ģ. Right click on the title link of the form you want to save.Ģ.

You may also save the form as a PDF to your computer, complete the form, and then print and mail the form to the address listed.ġ. Information and Forms: DTE 100 Real Property Conveyance Fee Statement of Value. DTE 100EX - Statement of Reason for Exemption from Real Property Conveyance Fee. Transfers are done in accordance with the Ohio Revised Code Section 319.203. To achieve the best results, we recommend the latest version of both your web browser and Adobe Acrobat Reader. DTE 100 - Real Property Conveyance Fee Statement of Value and Receipt.pdf.An alternative print version of most forms are available that have limited functionality but may be easier to open.The following forms are fillable PDF forms which can be opened, completed, and saved.To sort forms by "Form Number" or "Name/Description", click on that item in the table header.

0 kommentar(er)

0 kommentar(er)